Slightly off the beaten track today - no festivals, no food, no sightseeing. Instead I’ve decided to tell you about two new things that I’ve discovered in recent months and that have made a significant contribution to my quality of life as a certified International Woman of Mystery. And let me just say right off the bat that I’ve not received any kickbacks in consideration of my lavish praise for these products, though I would be very happy to do so. Anyone wanting to pay me off is welcome to get in touch at the email address below. No gift is too big or too small.

First is a product that came to me through Kickstarter. In fact, I’ve been kickstartering up a storm lately, though mostly that’s Gerald’s fault. He keeps sending me links to interesting clever things, and when something is really clever and useful and reasonably priced why wouldn’t you want to support it? Like, for instance, the Mogics Power Bagel - weird name, awesome idea. And perfect for someone who travels a lot.

I’m a great fan of the international plug strips that have cropped up recently, like this one here:

For a traveller though, there are a few problems with power strips like this. First, they are big and bulky, which is a definitely drawback. Second, while they accept any style of plug, they are only equipped to plug into a particular type of socket, meaning you still need a plug adapter to be completely versatile. And finally, if you’re trying to plug in things with large adapters, often you can’t use every outlet because the fat pluggy bit on the thing you’re plugging in is so large it hangs over the adjacent outlet.

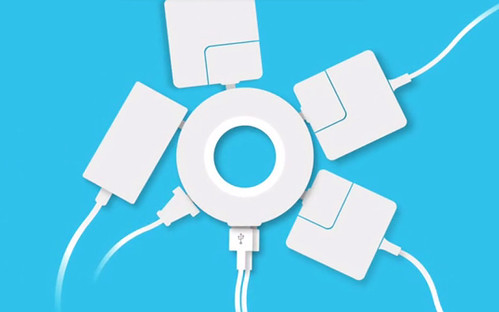

Enter: the Power Bagel! The big innovation with the Power Bagel is its shape - by turning the conventional strip into a circle the whole thing becomes much smaller. More importantly, though, the round shape means that when you connect something with a bulky plug it sticks out away from the circle, leaving room for something else in the next socket. It seems obvious when you see it.

The cord for plugging in the Bagel wraps neatly around the outside and stays wrapped at the length you want without interfering with plugging stuff in. And though the plug on the end of the cord is the little North American style, you can also get a universal adapter that slots neatly into the hole in the bagel for storage. The adapter is very clever too, and the smallest plug adapter I’ve ever seen. And trust me, I’ve encountered a lot of travel adapters in my time.

Mogics also offers something they call the Power Donut, which only accepts North American plugs. It’s the same diameter but a bit lower profile. I suppose the single plug style would be fine if you never left the continent and were just interested in having a convenient power source, but my feeling is that for the small extra cost it’s worth having the flexibility of the universal plug sockets. Why? Well, when I visited Belgrade with Rob and Wes, there was only one plug point near my bed, and it was taken up by the only lamp for the room. Because I had the Power Bagel, I was able to plug the euro style lamp into the Bagel, along with everything else I needed and still only use the one plug point. If I only had the ability to plug in things with a North American plug I’d have been sitting in the dark. Hence, the wisdom of the universal Bagel even for people who only own things with North American plugs. Both the Donut and the Bagel sell on the Mogics website for $49 USD.

I do have two quibbles though. The Power Bagel comes with a cute zippered case - it looks like a donut, including the hole in the middle. However, the plug adapter thing slots into that hole for storage, meaning that the only thing that’s not attached - the adapter - is the only thing that’s not held into the case. For a company that’s smart enough to think up such a clever device, that’s just plain dumb.

The other problem is that I’ve managed to blow the tiny built-in fuse in my Bagel twice now, though perhaps that says more about the power supply in Baku than the Power Bagel. On the plus side, the Bagel comes with a spare fuse packed inside the device and another spare fuse in the adapter. This means that I’m still operational, though I’m now working without any spares, and the shipping policy for getting more from the Mogics website is challenging for a person of No Fixed Address. In any case, the Mogics Power Bagel is still a hugely useful and very clever thing, and I suspect I will never travel without it.

Next up in the Go Stay Work Play Live lineup of Things To Not Leave Home Without is less a product and more a service. Or app. Or something. Whatever it is, it’s become an absolute necessity in my current ex-pat lifestyle.

Revolut describes itself as "the only account you need to securely send and spend money anywhere in the world.” Basically, it’s a smartphone app that links to a pre-paid Mastercard debit card. After downloading the free app, you sign up and are instantly assigned a virtual Revolut Card that appears on the screen and is functional right away, even as you wait for the actual physical chip-and-pin card to arrive in the mail.

After signing up you connect your Revolut account to an already existing bank account, which allows you to top up your Revolut balance from that account from within the app. You can even set it to top up automatically when your card balance gets below a certain amount. This easy in-app top up feature is currently only available if your primary account is in the UK or Europe, but you can also use a bank transfer to top up, it’s just not as fast or cool. And whenever a transaction occurs - either when you use your card in a store, or withdraw cash - you get an alert on your phone that’s very reassuring.

But none of that is really the point. There are other pre-loadable debit cards out there, and lots of different Mastercard options. The point of Revolut is that it operates in more than 120 currencies and instantly converts to your native currency using interbank rates. If I buy groceries in Baku and pay with my Revout card, as soon as the cashier pushes the enter button on the chip-and-pin device, the alert on my phone pops up to say I’ve just spent £23.31, which is 50.56 manat, at a rate of 2.1695 manat to the pound. This usually happens before the receipt is even printed. And - perhaps most importantly - it happens with no fees. My bank statements used to be littered with “Non-Sterling Transaction Fees". On previous gigs they added up to hundreds of pounds. Now… nothing. I used the card traveling in Serbia, and it was equally seamless. And now I use it for any transactions (often online) when the currency isn’t pounds sterling. When I withdraw cash from an ATM it’s the same. I get the same great exchange rate, and no fees (Mostly. Keep reading). I’ve just had a look through some old bank statements from 2014 when I arrived in Baku for the first time and I can see one withdrawal of 200 manat cost me £7.67 in fees, or about 4.7%. That adds up very very fast.

True, last time in Baku I got a local bank account and bank card and could withdraw cash from there without fees, but that meant managing deposits into that account, and making sure that the total held in the local account didn’t get so high that I couldn’t get it out if I wanted. Manat are not convertible outside of Azerbaijan, so it’s best not to hold an excess of local currency. Now I just have the cash my pocket - less than 200 manat - and the rest is safely held in my UK account or in virtual Revolut-land.

Which leads us to a big question that comes up with online banking services - security. I think most people are now accepting (if maybe not always comfortable) with online banking portals run by big, known international banks, but might be nervous about something app-based that occupies the same sort of place in your head as Angry Birds or that one where you toss virtual bits of crumpled paper into a virtual bin. Fear not. Revolut stores customers' money in a pooled account at the actual grown-up non-Angry-Birds Barclays Bank. And they apparently use the same encryption systems as banks. (For anyone who understands: Sensitive data is stored in PCIDSS level-1 compliant data centre and all data passed between Revolut servers and third parties is 2048-bit SSL encrypted and transmitted by VPN tunnels. Phew!)

Ok, I said there are no fees and mostly that’s true. Revolut makes most of their money from the credit card fees charged to retailers when you use the card for purchases. However, there is a limit of £500 per month on free cash withdrawals. That hasn’t been a problem for me, but Revolut recently announced they’re slashing that total to £200 month in February 2017, with a 2% fee per transaction after that. Apparently the costs associated with dealing with ATMs across the globe have become unsustainable for them to maintain the £500 ceiling. There’s been a big uproar in the online community about this, but from where I’m sitting it’s still a good deal. 2% after £200 is still a lot less than 4.7% every time. Perhaps I could search around a bit more and find a better one, but frankly I can’t be bothered.

So that’s the big big advantage of Revolut: (virtually) no-fee life in a foreign currency. However, there are also other fun things too. It’s instantaneous and free to transfer money to other Revolut users, which is nice if, for instance, you’re out for lunch and one person picks up the tab. You can easily and quickly send them your share through the app. Gerald and I have been trading about £7 back and forth for months now. Though often Gerald pays me back in euros, because that’s the currency he operates in. Which brings me to another fun thing about Revolut - you can hold money in pounds, euros or US dollars - the app has three built in “wallets” in those currencies. So if Gerald pays me in euros it goes into my euro wallet. If I make a purchase in euros the app will automatically take it from the euro wallet if there’s enough to cover it. If I don’t want to hold euros, I can easily exchange them into pounds at the same favourable rates Revolut always uses.

You can also transfer to non-Revolut people by sending them a code they use to access the money. And you can transfer directly to other bank accounts as well - a process I’m testing out for the first time right now. If it works and is simple and cheap it could become my preferred method for moving money from the UK to my Canadian accounts. Mostly, though, Revolut has become my day-to-day card for life in Baku ad my go-to card for anything that happens in a non-sterling currency. It's definitely made my life better.

An in other News About Pam: work is very busy because we all pack up for Christmas next week so there’s a scramble to get a mountain of tedious contracting and paperwork done. I’m fly back to London for a few days before I head home to Canada for Christmas and New Year’s, and then have a few more days in London before it’s back to Baku when we move to the stadium and get settled in for the long haul.

And finally, a few pictures of Christmas in Baku:

First is a product that came to me through Kickstarter. In fact, I’ve been kickstartering up a storm lately, though mostly that’s Gerald’s fault. He keeps sending me links to interesting clever things, and when something is really clever and useful and reasonably priced why wouldn’t you want to support it? Like, for instance, the Mogics Power Bagel - weird name, awesome idea. And perfect for someone who travels a lot.

I’m a great fan of the international plug strips that have cropped up recently, like this one here:

In fact, I think that every plug outlet on the planet should be like this - accepting North American, UK, Euro and Australian plugs equally, and generously equipped with USB ports. Could the UN maybe look into this please?

Enter: the Power Bagel! The big innovation with the Power Bagel is its shape - by turning the conventional strip into a circle the whole thing becomes much smaller. More importantly, though, the round shape means that when you connect something with a bulky plug it sticks out away from the circle, leaving room for something else in the next socket. It seems obvious when you see it.

No conflicts!

See how tiny!

And here is my Power Bagel in action in my hotel room in Baku. It’s currently powering the local euro plug standing lamp, the UK plug power for my computer, USB cables for phone and wireless speaker charging, and a euro plug for the desk lamp. And there’s still one universal and one North American plug left.

I do have two quibbles though. The Power Bagel comes with a cute zippered case - it looks like a donut, including the hole in the middle. However, the plug adapter thing slots into that hole for storage, meaning that the only thing that’s not attached - the adapter - is the only thing that’s not held into the case. For a company that’s smart enough to think up such a clever device, that’s just plain dumb.

Dumb

Next up in the Go Stay Work Play Live lineup of Things To Not Leave Home Without is less a product and more a service. Or app. Or something. Whatever it is, it’s become an absolute necessity in my current ex-pat lifestyle.

Revolut describes itself as "the only account you need to securely send and spend money anywhere in the world.” Basically, it’s a smartphone app that links to a pre-paid Mastercard debit card. After downloading the free app, you sign up and are instantly assigned a virtual Revolut Card that appears on the screen and is functional right away, even as you wait for the actual physical chip-and-pin card to arrive in the mail.

Here’s what the virtual card looks like. The real one is just like that too, with the nice purple colour. And my name on it. And no big black box covering the number. But otherwise it’s pretty much that.

But none of that is really the point. There are other pre-loadable debit cards out there, and lots of different Mastercard options. The point of Revolut is that it operates in more than 120 currencies and instantly converts to your native currency using interbank rates. If I buy groceries in Baku and pay with my Revout card, as soon as the cashier pushes the enter button on the chip-and-pin device, the alert on my phone pops up to say I’ve just spent £23.31, which is 50.56 manat, at a rate of 2.1695 manat to the pound. This usually happens before the receipt is even printed. And - perhaps most importantly - it happens with no fees. My bank statements used to be littered with “Non-Sterling Transaction Fees". On previous gigs they added up to hundreds of pounds. Now… nothing. I used the card traveling in Serbia, and it was equally seamless. And now I use it for any transactions (often online) when the currency isn’t pounds sterling. When I withdraw cash from an ATM it’s the same. I get the same great exchange rate, and no fees (Mostly. Keep reading). I’ve just had a look through some old bank statements from 2014 when I arrived in Baku for the first time and I can see one withdrawal of 200 manat cost me £7.67 in fees, or about 4.7%. That adds up very very fast.

True, last time in Baku I got a local bank account and bank card and could withdraw cash from there without fees, but that meant managing deposits into that account, and making sure that the total held in the local account didn’t get so high that I couldn’t get it out if I wanted. Manat are not convertible outside of Azerbaijan, so it’s best not to hold an excess of local currency. Now I just have the cash my pocket - less than 200 manat - and the rest is safely held in my UK account or in virtual Revolut-land.

Which leads us to a big question that comes up with online banking services - security. I think most people are now accepting (if maybe not always comfortable) with online banking portals run by big, known international banks, but might be nervous about something app-based that occupies the same sort of place in your head as Angry Birds or that one where you toss virtual bits of crumpled paper into a virtual bin. Fear not. Revolut stores customers' money in a pooled account at the actual grown-up non-Angry-Birds Barclays Bank. And they apparently use the same encryption systems as banks. (For anyone who understands: Sensitive data is stored in PCIDSS level-1 compliant data centre and all data passed between Revolut servers and third parties is 2048-bit SSL encrypted and transmitted by VPN tunnels. Phew!)

Ok, I said there are no fees and mostly that’s true. Revolut makes most of their money from the credit card fees charged to retailers when you use the card for purchases. However, there is a limit of £500 per month on free cash withdrawals. That hasn’t been a problem for me, but Revolut recently announced they’re slashing that total to £200 month in February 2017, with a 2% fee per transaction after that. Apparently the costs associated with dealing with ATMs across the globe have become unsustainable for them to maintain the £500 ceiling. There’s been a big uproar in the online community about this, but from where I’m sitting it’s still a good deal. 2% after £200 is still a lot less than 4.7% every time. Perhaps I could search around a bit more and find a better one, but frankly I can’t be bothered.

So that’s the big big advantage of Revolut: (virtually) no-fee life in a foreign currency. However, there are also other fun things too. It’s instantaneous and free to transfer money to other Revolut users, which is nice if, for instance, you’re out for lunch and one person picks up the tab. You can easily and quickly send them your share through the app. Gerald and I have been trading about £7 back and forth for months now. Though often Gerald pays me back in euros, because that’s the currency he operates in. Which brings me to another fun thing about Revolut - you can hold money in pounds, euros or US dollars - the app has three built in “wallets” in those currencies. So if Gerald pays me in euros it goes into my euro wallet. If I make a purchase in euros the app will automatically take it from the euro wallet if there’s enough to cover it. If I don’t want to hold euros, I can easily exchange them into pounds at the same favourable rates Revolut always uses.

You can also transfer to non-Revolut people by sending them a code they use to access the money. And you can transfer directly to other bank accounts as well - a process I’m testing out for the first time right now. If it works and is simple and cheap it could become my preferred method for moving money from the UK to my Canadian accounts. Mostly, though, Revolut has become my day-to-day card for life in Baku ad my go-to card for anything that happens in a non-sterling currency. It's definitely made my life better.

An in other News About Pam: work is very busy because we all pack up for Christmas next week so there’s a scramble to get a mountain of tedious contracting and paperwork done. I’m fly back to London for a few days before I head home to Canada for Christmas and New Year’s, and then have a few more days in London before it’s back to Baku when we move to the stadium and get settled in for the long haul.

And finally, a few pictures of Christmas in Baku:

Deck the hotel room with... cheap LEDs and plastic!

And who'd have thought Baku would have a Christmas Market?

1 Comment:

Hey Pam! Having just travelled to the US (Hawaii, to be specific) I am amazed at the high tech ways you are dealing with currency. I just figure (like my friend, Lila Henderson -- remember her?) that as long as I speak the language and understand the currency, all is easy! You open my eyes to new possibilities! Hope the year ahead is a great one for you. Take care, Colleen

Post a Comment